Condo Insurance in and around Tampa

Unlock great condo insurance in Tampa

Condo insurance that helps you check all the boxes

Calling All Condo Unitowners!

Because your condominium is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to theft or freezing pipes. That's why State Farm offers coverage options that may be able to help protect your largest asset.

Unlock great condo insurance in Tampa

Condo insurance that helps you check all the boxes

Condo Coverage Options To Fit Your Needs

You can kick back with State Farm's Condo Unitowners Insurance knowing you are prepared for the unpredictable with terrific coverage that's right for you. State Farm agent Ernest Walker can help you discover all the options, from a Personal Price Plan®, possible discounts to bundling.

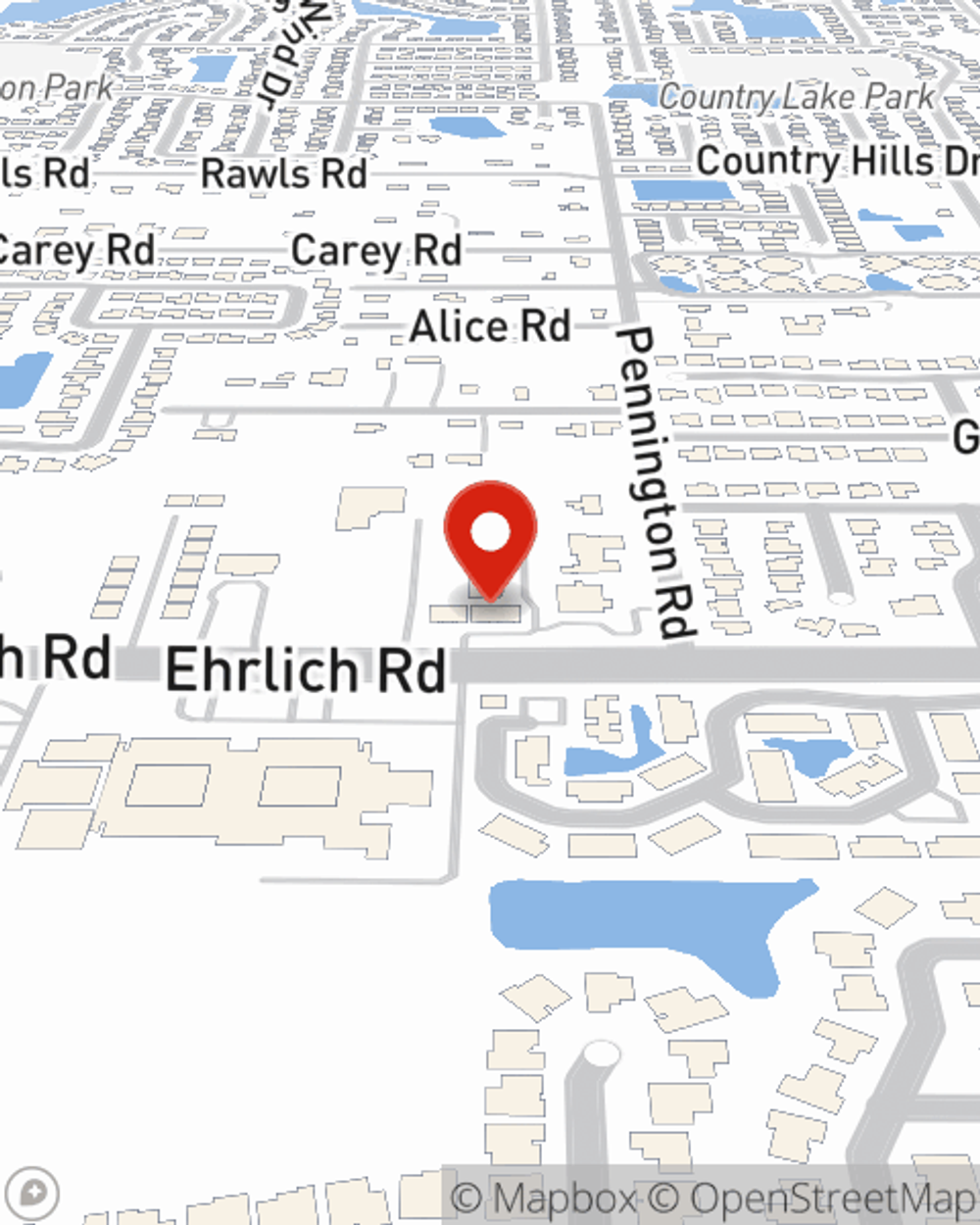

Visit State Farm Agent Ernest Walker today to check out how one of the top providers of condo unitowners insurance can help protect your condo here in Tampa, FL.

Have More Questions About Condo Unitowners Insurance?

Call Ernest at (813) 968-4043 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Ernest Walker

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.