Business Insurance in and around Tampa

Get your Tampa business covered, right here!

Helping insure small businesses since 1935

Your Search For Remarkable Small Business Insurance Ends Now.

You may be feeling like there's so much to think about with running your small business and that you have to handle it all on your own. State Farm agent Ernest Walker, a fellow business owner, understands the responsibility on your shoulders and is here to help you build a policy that's right for your needs.

Get your Tampa business covered, right here!

Helping insure small businesses since 1935

Surprisingly Great Insurance

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have counted on State Farm for coverage from countless industries. It doesn't matter if you are a sporting goods store or a real estate agent or you own an art store or a travel agency. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Ernest Walker. Ernest Walker is the agent who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

It's time to get in touch with State Farm agent Ernest Walker. You'll quickly perceive why State Farm is one of the leaders in small business insurance.

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

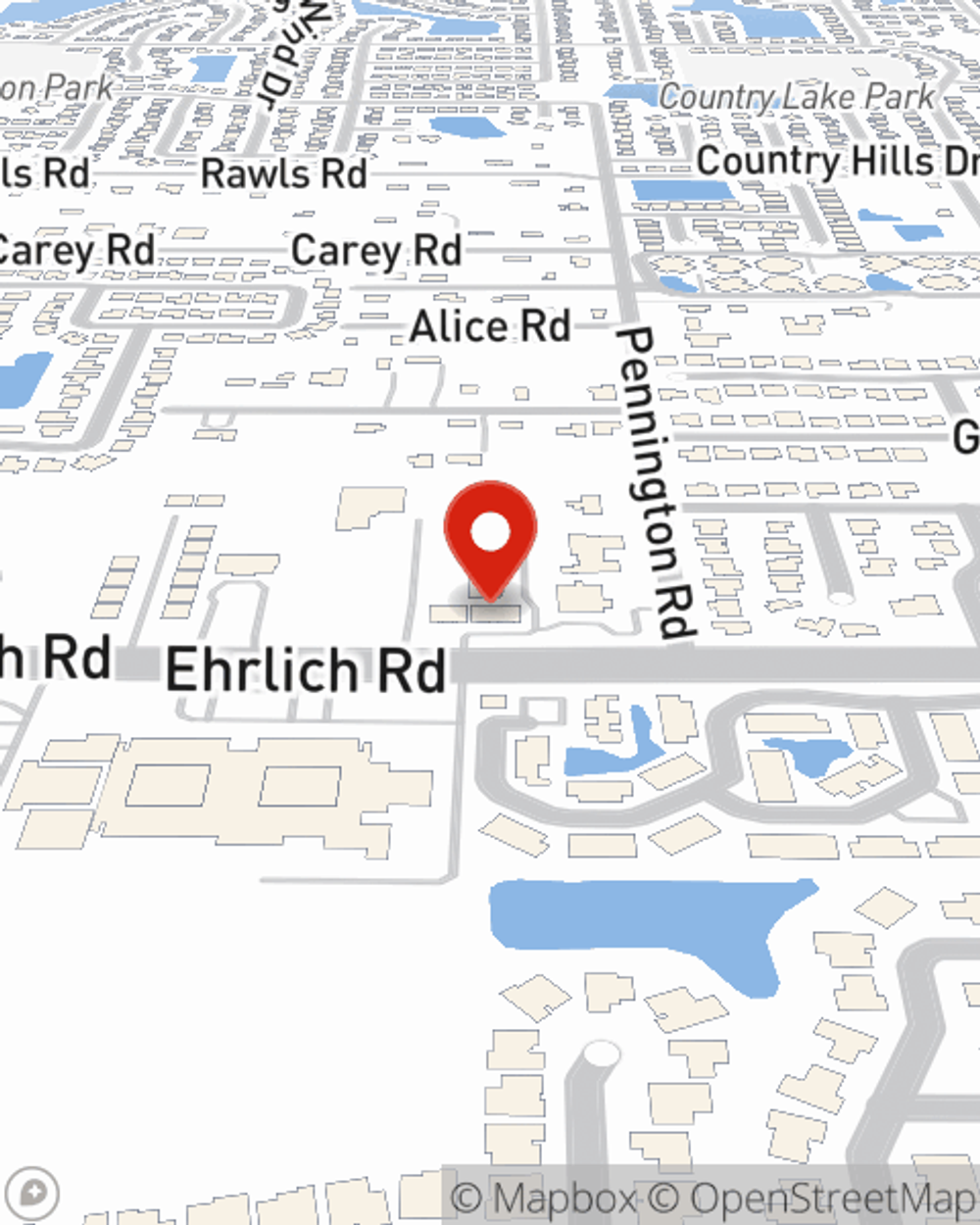

Ernest Walker

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.